Picking a Health Care Plan Assignment (100 points)Since this week is all about Health Care, I think it’s appropriate to have you research and select a Health Care Plan for yourself and your family (if you have a spouse/kids). If you already have a plan, you may include it as ONE of the options you research, but you still have to evaluate if it is STILL the best plan for you (if you are still under your parents plan, you may use that as one of the options you research- and find out how much your family can afford.)If you currently do not have an income, you can use a budget amount that you think would be realistic for when you will have an income (ie: move out and are supporting yourself).The assignment is to attach a Microsoft Word (or PDF) document to this assignment with the following parameters: Typed, double spaced, 12 point font. Length should be 2-5 pages… whatever you need to be complete. Please write this in an ‘Essay’ type of discussion style, not in a numbered question and answer style. Include an Introduction, a Body and a Summary of the discussion. Please check out this link to make sure you follow proper essay structure. (ESSAY STRUCTURE)There should be 3 sections in your Essay: Introduction Body SummaryThe Introduction should cover: WHO you are looking to cover (yourself? spouce? kids?); What are your health care needs? Do you want to keep your current doctors? How much can you afford per month to pay for a plan?Body of the Essay: With the above information you answered, you will research 3 Health Care Plans from different Companies of your choosing and find one plan within each of the 3 companies that you feel fits your needs at this time. COMPARE each of the 3 plans with each other (NOT the 3 Companies! — but rather a specific plan within each company… I do NOT want to see any comparisons of HMOs vs PPOs or Aetna Vs Keiser…. but rather the Aetna 1500 plan vs Keiser’s 2500…etc.)The body should include: Who is covered (individual or family)? Type of plan…PPO/HMO? Cost of overall plan? Co-Pays / Out of pocket expenses? What services or types of treatment are covered/ what items of importance to you are not covered? Doctors – are yours ‘in network’ or ‘out of network’? Convenient locations for treatment? and any other needs/interests you may find to compare.The Summary: After all the comparisons, summarize your findings and CHOOSE ONE of the health plans that you think would be the best for you and explain why.Helpful Information:I have posted 3 examples of good work for this assignment to give you an idea of what I’m looking for:Picking a Health Plan – Example 1Picking a Health Plan – Example 2 Picking a Health Plan – Example 3 There are a lot of things to consider when choosing a health care plan. Here are some ideas to consider: What are the current and future health care needs in your household?Do you think you will use health care services often or just rarely? That answer can help you decide whether to choose a plan that offers basic coverage, or one with broader benefits. Do you want to keep your current doctors?Will you want to keep seeing your doctor? That might dictate the type of plan you choose. HMO plans require that you use doctors in the network. So, check to see if your doctor is in the network. Or consider a Preferred Provider Organization plan. It lets you visit almost any doctor. How much can you afford to pay for health insurance?Knowing your price range can help narrow the options.Make sure you understand your costs. You will have a monthly cost for your plan and other expenses, such as an annual deductible or payments for office visits. Plans with higher monthly costs tend to have lower costs for office visits and other services. If you want lower monthly costs, you will pay higher costs for office visits and other services. What health expenses will the plan cover?When comparing plans, look to see what expenses are covered. Will the plan pay for physicals, shots and other preventive care? How about prescription drugs or dental care? Some plans cover expenses like these, some do not. Be sure to understand and assess the benefits of each plan you are considering.

by Classy Writers | Jun 8, 2020 | Physics

Picking a Health Care Plan Assignment (100 points)Since this week is all about Health Care, I think…

A professional Academic Services Provider

Superb Writers Classic Essays Prioritizes Quality, Accountability, Professionalism, and Timely Delivery

At Superb Writers, we have qualified experts including writers providing quality papers at all times. The company seeks to aid learners all through the education process while easing their journey. Customer satisfaction is our emblem, and as the name suggests, our customers have a SUPERB experience with us. We purpose to help learners comprehend their classwork and homework to attain high grades. Our writers, editors, managers, customer service personnel are friendly; hence, providing a conducive environment to interact with you; the client. We offer guidance across various tasks including essay wring, article writing, thesis proposals, dissertations, coursework, and project management among others.Our Core Values

1. Professionalism: Our staff are highly trained to accommodate every personality. We handle our clients respectfully, understanding the fact that we are here because of you.

2. High-Quality: As typified by our name, we provide quality services as desired by our clients.

3. Confidentiality We safeguard what we share with our clients; hence, information shared remains confidential.

Assurances

4. Quality Assurance: Our qualified writers are clustered as per their expertise and tasks matched with the respective fields. Moreover, we have the current software to check paper quality; thus, delivering error free products.

5. Money Back Policy: As a client-oriented service, we offer 100% refund for the following: if we received a double payment from you; if you placed similar orders twice (or more) and paid for all of them; the writer has not been assigned; you asked to cancel the order within 20 minutes after placing it; an e-Check payment has been sent (the Dispute Manager will contact you accordingly). Other cases involve a comprehensive investigation by the Dispute Department and feedback given within 24 hours. We value our customers; therefore, the process will be fair, fast, and precise.

5 .Free Revisions: You can request for revisions at no additional cost. However, this does not entail complete change of the initial order instructions and if it is not past ten days upon your approval.

6. 24/7 Customer Support: Our support team is always available to help when needed.

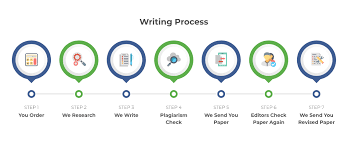

Process of Placing an Order

NOTE: If you have any question, always contact our support team before the commencement of your project. ALL THE BEST”:

Recent Comments