reply in 150 words to student responce to question along with 1 reference as well as answer Which one of the advantages that you mentioned is more important to the venture capital companies? student responce3.Why do venture capital companies often choose preferred stock for their equity position?First you have to understand preferred stock is a stock in which holder have preferential rights to receive fixed dividend and proceeds of liquidation over that of ordinary share/common stock.Most Venture capital companies often choose preferred stock for their equity position as it gives VCs special preferences and protections. The preferred stock is entitled to receive a specified amount of the proceeds from liquidation before the common stockholders receive anything. This liquidation proceeds often exceeds size of initial investment. Preferred stockholders are entitled to receive fixed dividend payments before common stockholders receive any dividend payments. VCs favor preferred because they tend to take an active role in the control and management of their portfolio companies, and American corporate law does not generally allow bondholders to take such a role. Venture capital in US typically receives convertible preferred stock. It means preferred stock may be converted into common stock at some point. If VCs were to invest in the company through common stock, the IRS would have a benchmark for valuation that is the amount paid by the VCs. On the other hand, preferred stock does not provide such a benchmark for valuing the common stock because it consists of a different bundle of rights. Preferred stock allows startups to reduce the effective tax burden on employees, and thus the pretax cost of compensation for the firm.

by Classy Writers | Jun 9, 2020 | Business & Finance /Management

reply in 150 words  to student responce to question along with 1 reference as well as answer Which…

A professional Academic Services Provider

Superb Writers Classic Essays Prioritizes Quality, Accountability, Professionalism, and Timely Delivery

At Superb Writers, we have qualified experts including writers providing quality papers at all times. The company seeks to aid learners all through the education process while easing their journey. Customer satisfaction is our emblem, and as the name suggests, our customers have a SUPERB experience with us. We purpose to help learners comprehend their classwork and homework to attain high grades. Our writers, editors, managers, customer service personnel are friendly; hence, providing a conducive environment to interact with you; the client. We offer guidance across various tasks including essay wring, article writing, thesis proposals, dissertations, coursework, and project management among others.Our Core Values

1. Professionalism: Our staff are highly trained to accommodate every personality. We handle our clients respectfully, understanding the fact that we are here because of you.

2. High-Quality: As typified by our name, we provide quality services as desired by our clients.

3. Confidentiality We safeguard what we share with our clients; hence, information shared remains confidential.

Assurances

4. Quality Assurance: Our qualified writers are clustered as per their expertise and tasks matched with the respective fields. Moreover, we have the current software to check paper quality; thus, delivering error free products.

5. Money Back Policy: As a client-oriented service, we offer 100% refund for the following: if we received a double payment from you; if you placed similar orders twice (or more) and paid for all of them; the writer has not been assigned; you asked to cancel the order within 20 minutes after placing it; an e-Check payment has been sent (the Dispute Manager will contact you accordingly). Other cases involve a comprehensive investigation by the Dispute Department and feedback given within 24 hours. We value our customers; therefore, the process will be fair, fast, and precise.

5 .Free Revisions: You can request for revisions at no additional cost. However, this does not entail complete change of the initial order instructions and if it is not past ten days upon your approval.

6. 24/7 Customer Support: Our support team is always available to help when needed.

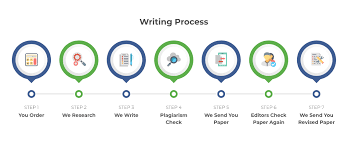

Process of Placing an Order

NOTE: If you have any question, always contact our support team before the commencement of your project. ALL THE BEST”:

Recent Comments